Quick Look: What’s Moving the Market

Home sales are down slightly this week, holding a slow but steady line in what’s become a tug-of-war between high rates and tight inventory. According to the latest national data, existing-home sales fell 1.9% compared to last month. That’s not a collapse—but it’s not growth either.

Mortgage rates showed modest improvement, averaging 6.76% for a 30-year fixed. That’s down a hair from the prior week, but still enough to keep some buyers on the sidelines. On the flip side, that tiny drop may be just enough to spur action among those already house hunting. Every quarter-percent counts when monthly payments are tight.

On to inventory. It crept up 3% this week, mostly due to a seasonal listing bump. But it’s still 24% lower than the same time pre-pandemic. Translation: buyers are choosing from a smaller menu, while sellers who price correctly are seeing offers fast—especially in mid-tier segments.

Median home prices clocked in at $426,100 nationally, up 0.8% week-over-week. Not a surge, but consistent with the slow upward grind driven by lack of supply. Price reductions are growing in some overheated markets, but overall demand remains strong in metros with job growth.

In short: leverage is tilting just a bit toward buyers in stagnant or overpriced regions, while sellers still own the upper hand in tight, high-demand zones. The standoff continues—but momentum is beginning to shift. Keep an eye on rates and inventory next week—they’ll set the tone heading into summer.

Top Story 1: Mortgage Rate Fluctuations and Buyer Confidence

Mortgage rates have been anything but predictable lately. After a steady climb through much of last year, recent economic data—paired with shifting Fed signals—has triggered a new wave of volatility. Inflation reports, employment numbers, and global tension all play their part. Day to day, rates are swinging more than buyers or brokers would like.

This uncertainty is messing with buyer psychology. Some are feeling the pressure to lock in a loan before rates bump up again. Others are tapping the brakes, holding out for a drop that may—or may not—come. The result? A market caught between urgency and hesitation. Homes sit longer in some areas, while others see bidding wars break out just because a lender offered a slightly better rate that week.

Deal timelines are stretching. Agents report more last-minute renegotiations, delayed closings, and buyers ghosting after pre-approvals. In today’s rate-sensitive market, even a quarter-point shift can reshape affordability—and change minds fast. If rates keep bouncing, so will buyer confidence. That means sellers and agents need to stay light on their feet and ready to pivot.

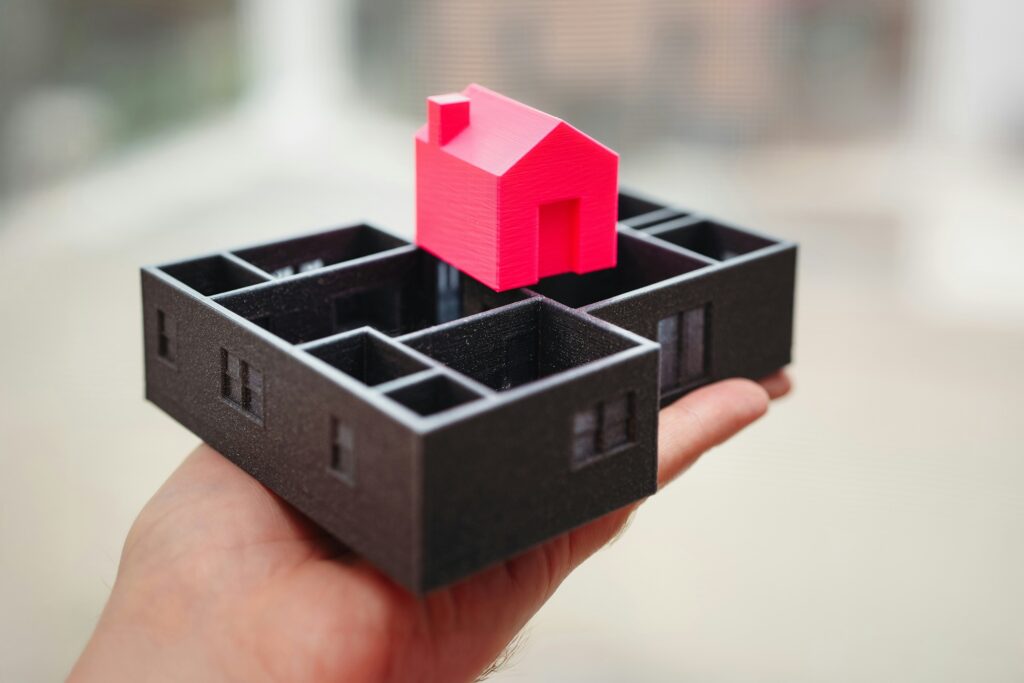

Top Story 2: Inventory Crunch in Major Metros

Listings are getting scarce—especially in places like Austin, San Diego, and Charlotte. Whether it’s retiree-heavy neighborhoods or hot job markets, inventory has tightened up in ways we haven’t seen since early pandemic days. Homeowners with low mortgage rates are staying put, and fear of not finding a replacement home has frozen a chunk of would-be sellers. This gridlock is making freshly listed homes feel like gold.

As for builders, the response has been mixed. Some are accelerating timelines in high-demand areas, but labor shortages and higher material costs are slowing others down. In some cases, even with buyer demand lingering, new housing starts are actually tapering off. The response just isn’t matching the level of scarcity.

Tight inventory means buyers are competing harder. We’re seeing upticks in multiple-offer situations again—even price escalations in certain zip codes that had cooled off last year. For sellers, it’s a moment of leverage. For buyers, it’s back to the drawing board: more compromises, faster decision-making, and sometimes bidding over list. Prices aren’t spiking across the board, but tension is rising—and in many metros, the edge is clearly shifting back to sellers.

Top Story 3: Remote Work Continues to Influence Migration

Migration patterns aren’t random anymore. They’re practical—and still deeply tied to remote work. As of this quarter, top inbound states for homebuyers include Florida, Texas, Tennessee, and the Carolinas. Lower taxes, milder weather, and relatively affordable housing are the magnets. On the flip side, states like California, New York, and Illinois continue to see major outbound traffic, driven by high costs and shifting work dynamics.

What’s more interesting this year is how suburbs and small towns are stepping into new roles. They’re not just bedroom communities anymore—they’re becoming standalone hubs. Towns within 60-90 minutes of major cities are seeing growth, not just in population, but in local business infrastructure. That means better schools, updated amenities, and, yes, higher price tags.

The long-term effects on local markets are already showing up. Smaller cities are drafting housing development plans to meet the inbound pressure. Meanwhile, pricing strategies are shifting from pure competition to sustainability—balancing growth while trying not to price out locals. For agents and investors, this ongoing migration isn’t just movement—it’s strategy.

Investor Watch: What the Pros Are Doing Right Now

The big players are zeroing in on targeted opportunities, and it’s telling. Multifamily continues to be the workhorse for investors—especially Class B buildings in growing secondary cities. Steady rental income and decent cap rates keep institutional buyers circling, even with tightening margins. Vacation rentals are also catching new heat, mostly in regulation-friendly zones where tourism has bounced back and remote work makes weekend getaways stretch longer.

Institutional funds are shifting gears. Instead of focusing only on primary urban centers, they’re increasingly scooping up assets in suburbs and mid-size metros. Think single-family rental portfolios outside of Austin or small apartment complexes near Raleigh. The bet isn’t just on population growth—it’s on affordability migration. People are moving out, not slowing down.

On the rental side, demand is holding strong, but pricing power is regional. Sun Belt cities are still inching upward, while some legacy markets (looking at you, San Francisco) have softened. Regulatory pressures are heating up too, with new rent caps and tenant protections in the pipeline, especially in politically reactive metros. If you’re a private investor looking at the rental game, watch not just the returns—but the headlines.

This phase of the cycle demands selectivity over volume. The sharpest investors are narrowing focus, staying nimble, and reading between the macroeconomic lines.

Spotlight: Policy Changes and New Legislation

The regulatory landscape is shifting, and real estate professionals need to keep their eyes on recent and upcoming policy changes. From property taxes to zoning laws and tenant protections, new legislation is reshaping how deals are structured and who stands to benefit—or lose.

Key Legislative Updates to Watch

- Property Tax Reforms: Several states are implementing or proposing caps and adjustments to property taxes, largely in response to affordability concerns. These moves could lower barriers for entry in certain markets but may strain local government budgets.

- Zoning Flexibility: Cities across the country are relaxing single-family zoning in favor of multi-use and higher-density housing. This opens doors for more development, especially in high-demand urban areas.

- Tenant Rights Expansion: States like California and New York are advancing renter protection bills, including limits on eviction procedures, rent hikes, and security deposit practices.

Impact on Different Stakeholders

- Buyers: Zoning reforms could expand inventory in tight markets, while tax changes may alter long-term affordability and resale value.

- Landlords: New tenant protections will require closer compliance with leasing laws, potentially increasing the operational complexity of managing rentals.

- Developers: Eased zoning laws open new opportunities—especially in previously restricted neighborhoods—but also come with increased scrutiny over community impact and environmental regulation.

Geographic Hot Zones

Here are some areas where policy shifts are especially active:

- California: Legislation focused on tenant rights and ADU (Accessory Dwelling Unit) expansion.

- Texas: Ongoing debates about property tax reforms and land-use autonomy for local governments.

- Minnesota and Oregon: Progressive zoning changes pushing for affordable multifamily housing.

- Florida: New ordinances around short-term rental regulation and coastal development.

Tracking these changes in real-time can offer a major strategic edge, particularly for investors and developers aiming for long-term growth.

For deeper insights into how legislation is reshaping market dynamics, visit HouseZoneSpot.

Housing Tech: Innovation Corner

Last quarter confirmed what the real estate world already suspected: proptech isn’t just a buzzword—it’s turning into a necessity. From smart document automation to AI-powered lead qualifiers, the industry is shifting toward speed and efficiency at every stage of the transaction. Virtual staging in particular is having a moment, offering agents the chance to transform listings in hours, not days, and giving buyers a better sense of “home” before ever stepping inside.

AI technologies are quietly doing the heavy lifting—predictive pricing tools, chatbots that actually work, and data dashboards that help brokers see shifts before they’re headlines. It’s not about full automation, but optimized decision-making. The kind that makes human agents faster, sharper, and more available.

Adoption is climbing steadily. According to a recent industry survey, over 65% of agents now use at least one AI or automation tool in their daily workflow. Brokers are investing in all-in-one platforms, while digitally native homebuyers increasingly expect tech-fueled, low-friction experiences, from viewing to close. Bottom line: if you’re not plugged in, you’re behind.

Final Take: What to Expect Next Week

As we head into another week, all eyes are on a few key economic signals. Keep watch on the Fed’s language around inflation and interest rates—any hint of a shift could jolt mortgage rates again. Also worth tracking: jobless claims, consumer spending data, and housing starts. Together, they paint a clear picture of where market confidence is really headed.

Seasoned analysts are cautiously optimistic. Some expect a modest easing in borrowing costs later this quarter if inflation cools off and the economy doesn’t overheat. Still, nobody’s betting the farm. Regional disparities are wide, and even small changes in demand or lending can have outsized local impacts.

For first-time buyers, it’s a good idea to lock in pre-approvals early and keep tabs on local supply. Sellers should focus on realistic pricing and prep work—homes that are move-in ready often get faster, stronger bids. Long haulers? Watch secondary markets and up-and-coming zip codes where growth and pricing power are trending up.

For more insights, neighborhood breakdowns, and deep dives, check out HouseZoneSpot

Billake Bartow is a passionate tech writer at HouseZoneSpot, known for his deep understanding of smart home innovations and digital living. His articles focus on practical technology that enhances everyday comfort, convenience, and energy efficiency in modern homes.

Billake Bartow is a passionate tech writer at HouseZoneSpot, known for his deep understanding of smart home innovations and digital living. His articles focus on practical technology that enhances everyday comfort, convenience, and energy efficiency in modern homes.